Real estate investing in Canada continues to pay dividends, with growth in house prices far outpacing gains in volatile equity markets over the past 12 months.

Real estate investing remains a highly lucrative opportunity for Canadian investors. The average price of a Canadian home sold in March surged by 9.1% over year-ago levels, far outpacing gains in the volatile equity markets and offering further evidence that residential real estate continues to be a main wealth generator for Canadian investors.

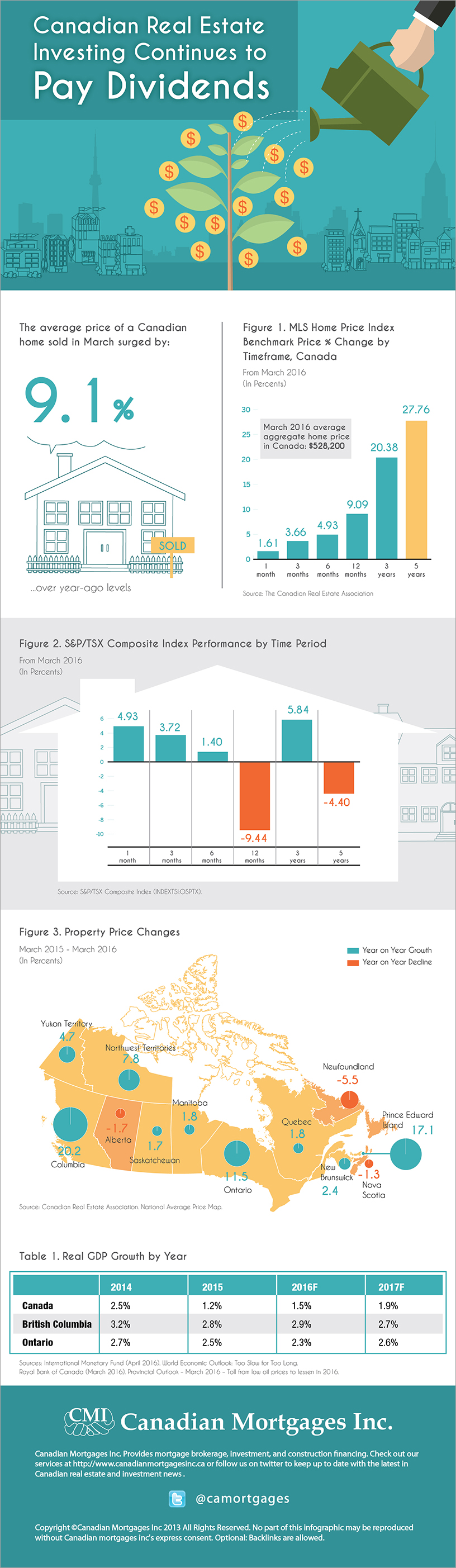

The average sale price of a Canadian home reached $528,200 in March, according to data from the Canadian Real Estate Association (CREA). The 9.1% annualized increase in the average sales price was the biggest since June 2010 and came despite a modest slowdown in Greater Vancouver and the Greater Toronto Area (GTA). Excluding these two regions, the average sales price of a Canadian home is a much more modest $366,950.[1]

Canadian home prices have risen nearly 28% in the five years through March 2016, with every major region registering gains of at least 5.62%. In the case of the GTA, the average sales price has skyrocketed nearly 43%. For Lower Mainland and Greater Vancouver, the average sales price is up 36.73% and 39.05%, respectively.[2]

By comparison, average returns in the Canadian stock market have been far less robust, reflecting increased volatility and uncertainty in the global financial markets. The S&P/TSX Composite Index declined 4.40% in the five years through March 31. Much of the decline has been concentrated over the last 12 months, where the value of the TSX has plunged over 9% (figure 2).

Global equity markets have experienced extreme volatility through the first four months of the year. The outlook on equities remains largely negative, as the combination of weak global growth, dismal corporate earnings and volatile commodity prices continue to push investors away from stocks and toward safe haven assets.

The value of Canadian real estate is rising at a time when the broader economy isn’t performing nearly as well. Canada entered a technical recession in the first half of 2015, as the oil price collapse weighed on the regional economies of Alberta and Newfoundland and Labrador. House price growth in these regions has turned negative as a result. However, most provinces and territories for which there is data have shown a modest-to-large uptick in home prices over the past 12 months (see figure 3). Overall, these figures point to a strong, stable residential real estate market throughout the country.

According to analysts, home ownership and secondary properties are smart investment strategies for individuals looking for stable returns on investment over the long haul. The key to success is choosing desirable neighbourhoods in recession-resistant markets that offer large upside and continued buyer interest. Locales with strong labour markets and steady economic growth make ideal locations for investing in real estate. In Canada, Ontario and British Columbia continue to be the main draws for real estate investors looking to tap into high-growth regions. Both provinces are outpacing the national average in terms of GDP growth, making them prime real estate locations (table 1).

While some investors are concerned that prices are rising too fast in these regions, inventories in these and other provinces are extremely tight, which suggests that supply is barely keeping up with demand. In Vancouver, for example, there was a 91% sales-to-new listings ratio at the beginning of the year, which suggests that every new listing was being absorbed within one month.[3]

Additionally, Canada is a hotbed for foreign investors who are increasingly drawn to the country’s stability and high quality of life. For them, investing in places like Toronto, Vancouver, Ottawa, Calgary and several other CMAs is a no-brainer. While this is a growing cause for concern for policymakers looking to rein in price growth, it nevertheless shows that buyer interest remains high. (In the case of Vancouver, this has gotten a little out of hand, with the average price of a home hitting a staggering $1.4 million in April.[4])

Outside of Vancouver and Toronto, there are several Census Metropolitan Areas (CMAs) that offer high-growth opportunity for investors looking to tap into the Canadian market. Cities like Hamilton, Regina, Winnipeg, Edmonton and Barrie, among others, continue to offer high-growth potential at more affordable prices.

Buyers looking to gain exposure to multiple markets can also invest in a mortgage investment corporation (MIC), which represents ownership in a diversified residential mortgage portfolio. The Canadian Mortgages Inc. MIC represents ownership in first and second residential mortgages in strong, stable urban centres across Ontario and the rest of Canada. The Canadian Mortgages Inc. MIC generates an average annual compound return of between 8% and 9%, allowing investors to capitalize on a high-growth industry that is generating a higher ROI than many other investment vehicles.

References

[1] Canadian Real Estate Association (April 15, 2016). “Canadian home sales set record in March.”

[2] Canadian Real Estate Association. HP Tool.

[3] Pete Evans (February 16, 2016). “Average house price in Canada up 17% in January to $470,297.” CBC News.

[4] Camille Bains (May 8, 2016). “Foreign buyers crushing Vancouver home drams as governments do little: study.” CBC.