Canadians are carrying record debt levels and seem ready to handle more. Is this a cultural norm or lack of credit education?

Nearly three-quarters of Canadian families carry some form of debt.[1] This figure is expected to increase as debt acceptance remains a cultural norm. But under the seams of this cultural norm are big issues that threaten to undermine the economy.

Latest economic figures from around the world confirm that we are a civilization of debtors. Since the 2008 financial crisis, global debt has increased by a whopping $57 trillion, outpacing GDP growth by a wide margin.[2]

Canadians have certainly grown more addicted to debt over the decades as the culture of debt acceptance impacts younger generations. As you’ll soon see, household debt in Canada is on the rise, and this is beginning to have a real impact on the economy. Below we explore the impact of growing indebtedness on Canada and look at reasons why so many consumers can’t seem to put away their credit cards.

The Cold Hard Truth: Consumers Lack Education

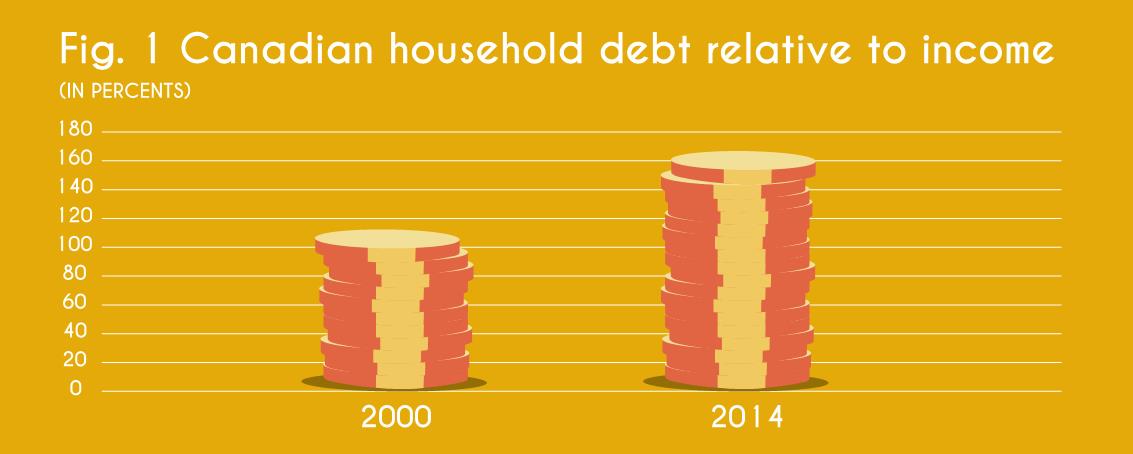

Household debt has been steadily rising throughout the decades. Between 2000 and 2014, household debt relative to income surged 50% (Figure 1).[3] While demand for credit is rising, an understanding of how to manage it is severely lacking. According to experts, an increasing number of Canadians lack financial education, which is raising concerns that consumers are taking on a bigger debt burden than they can afford. In other words, consumers are poorly educated about the value of credit and how it works.

As a key example, consider how much money consumers are paying to credit card companies each month. In many instances, credit cards carry with them an interest rate of over 20%. For those who choose to carry a balance – and research shows that’s about 4 in every 10 people[4] – this can add up to thousands of dollars in interest payments each year. Over the course of a lifetime, that can add up to hundreds of thousands of dollars.

Carrying a balance on credit cards with high interest rates is a sign that financial literacy is lacking. Research shows this problem is getting worse. According to TransUnion, Canadian credit card debt reached a two-year high last year – and that was before the holidays.[5]

Source: Office of the Parliamentary Budget Officer.

Canadian Household Debt on the Rise

As we outlined above, Canadians are no strangers to credit. The problem is actually much bigger than it appears at first. As of 2015, Canadian households are carrying the biggest debt-to-income ratio in the G7. Canada’s household debt reached a massive 171% of disposable income in the third quarter of 2015. This means that, for every $100 of disposable income, Canadian households carry $171 in debt. This is the highest level since 1990 and doesn’t bode well to Canada’s long-term stability. The government recently warned that household debt could reach 174% of disposable income by the end of the year. Once again, that means Canadians will carry $174 in debt for every $100 in disposable income they have.[6]

While this may appear to be a problem at the surface, there may be additional explanations for why Canadians are able to carry such high household debt. One such explanation is the changing nature of employment through information technology, which is giving people more opportunity to enjoy non-traditional income outside their 9-5 jobs.

The Sharing Economy

One prominent example of this is the so-called sharing economy, a model of peer-to-peer-based sharing of physical or intellectual resources. Resources like Uber, Airbnb and several others are having an enormous impact on our daily lives. In the process, they are creating new economies enabling people to increase their income manifold. Best of all, they can participate in such income-boosting activities at any time.

Freelancing is having a similar effect. There are literally tens of millions of freelancers (perhaps even more) all over the world earning extra income through popular websites like Upwork, Freelancer and many others. In fact, Forbes published an article in January where it showcases just how prevalent flexible freelance work has become. According to Forbes, 50% of the US workforce will be freelancers by 2020 (note: this doesn’t mean they will be full-time freelancers, but that one out of every two workers will freelance to some capacity).[7] We expect a similar trend in Canada, which is a comparable nation in terms of employment trends and access to information technology.

As you can tell, these examples are endless. The point being, we live in an information age that is making it more possible than ever for people to increase their income through various channels. These trends suggest that holding a debt-to-income ratio of 171% might not be as high as it used to be. Additionally, Canadians have much lower healthcare and education costs as other parts of the world, such as the United States. This also has to be factored in when discussing household debt and their ability to manage it effectively.

Having said that, there is strong reason to believe that many Canadians are still carrying too much debt. This makes it all the more necessary for more people to seek out credit education that can help them become more financially independent and ensure they’re not wasting thousands of dollars on high interest rates.

Improving the Credit Drag

Low levels of financial literacy have been linked to rising debt levels and poor decision-making, which could impede economic growth and stability.[8] Yet, when one looks around, there aren’t many sources of formal credit education programs available to Canadians that can truly make an impact on consumer finances. This is complicated by the fact that many credit providers are advertising guaranteed loans at favourable rates. Numerous studies have shown that Canadians lack a basic understanding of personal finances and credit,[9] with the majority admitting they don’t ever check their credit score.[10]

Financial literacy not only makes debt management easier, it can help consumers save tens or even hundreds of thousands of dollars in interest payments over the course of a lifetime. This can help lower the country’s debt burden, which can in turn help Canada increase its savings rate. Countries with higher savings rates are usually better positioned economically, especially during a recovery.

As we’ve seen repeatedly over the past decade, national economies don’t respond well to defaults, which have become endemic to the modern credit system. Higher savings allow households to absorb rising expenses. They also equate to lower living expenses. Ultimately, these actions pull nations out of recessions much faster. After all, households that pay their bills help the economy sustain itself during periods of uncertainty.[11]

The Need for Formal Credit Education

In order to get there, however, Canadians need formal credit education and financial literacy programs. The earlier those programs are offered, the better. Debt management services won’t do the trick because these companies usually enter the picture after a consumer realizes he or she needs help keeping their personal credit under control. Canada needs less debt management services and more financially literate consumers who understand credit and interest rates.

Remember, there’s nothing inherently wrong with credit when it is used responsibly and at the lowest possible cost to the consumer. However, debt acceptance has run amok, which means that consumers are no longer learning about financial management. Believe it or not, people used to buy cars and furniture through savings, not through high interest rate financing. Our growing reliance on debt not only dangerous for our economy, it takes us away from behaving like rational and responsible consumers. It also robs us of using our hard earned money for productive purposes, like saving, investing or starting a business. These efforts actually strengthen the economy, something Canada desperately needs in the current climate.

References

[1] Theresta Tedesco (May 8, 2015). “The deb ‘crisis’ in Canada? If your paycheque is $100,000 plus, that means you.” Financial Post.

[2] Richard Dobbs, Susan Lund, Jonathan Woetzel and Mina Mutafchieva (February 2015). “Debt and (not much) deleveraging.” McKinsey.

[3] Gordon Isfeld (January 19, 2016). “Canadians’ household debt climbs to highest in G7 in world-beating borrowing spree.” Financial Post.

[4] CBC.ca (July 30, 2015). Credit Cards: Statistics and Facts.

[5] Bertrand Marotte (November 18, 2015). “Credit card debt at two-year high heading into holiday season.” The Globe and Mail.

[6] Gordon Isfeld (January 19, 2016). “Canadians’ household debt climbs to highest in G7 in world-beating borrowing spree.” Financial Post.

[7] Brian Rashid (January 26, 2016). “The Rise Of The Freelancer Economy.” Forbes.

[8] Financial Consumer Agency of Canada. The Future of Financial Education.

[9] Investment Executive. “Majority of Canadians lack sufficient understanding of basic finance and credit: survey.” Investment Executive.

[10] CBC News (May 1, 2015). “Credit score never checked by Majority of Canadians” BMO report.” CBC News.

[11] Jonas Elmerraji (February 28, 2010). “How Savings Are Saving The Economy.” Investopedia.