Canadian home sales slowed last month, thanks to a 40% drop in Vancouver, the country’s most overheated market.

Canada’s housing market regained momentum in December, but a sharp decline in Vancouver sales skewed an otherwise positive picture.

National Sales Rebound in December

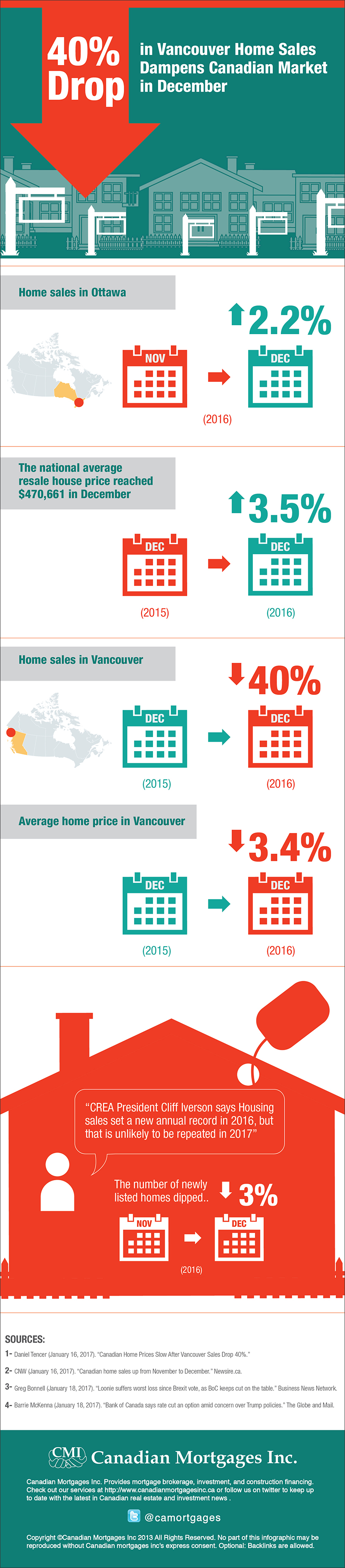

Sales of Canadian homes were up 2.2% in December from a month earlier, the Canadian Real Estate Association (CREA) recently reported from Ottawa. The gain more than offset a disappointing November, where sales dropped after tighter mortgage rules were introduced. The national average resale house price reached $470,661 in December, up 3.5% from a year earlier. That was the slowest annual gain seen in recent years.[1]

Average prices continued to be pulled up by surging demand in the Greater Toronto Area and Golden Horseshoe region, which are diverging from the rest of the country. These markets have the tightest balance between housing supply and demand, with inventories ranging between one and two months in many of these markets. Aside from the GTA and Southwestern Ontario, activity was relatively flat across Canada.

Vancouver Sales Plummet

Vancouver sales plunged 40% in December compared to a year earlier, taking the steam out of the nation’s hottest housing market. As a result, the average home price in the city declined 3.4% from a year earlier to $948,246.

Analysts argue Vancouver’s housing correction was already underway before the B.C. government introduced a new 15% tax on foreign buyers last August. The new measures appear to have accelerated the city’s soft landing after a prolonged period of double-digit percentage growth in real estate values.

Housing sales set a new annual record in 2016, but that is unlikely to be repeated in 2017, says CREA President Cliff Iverson.

“[T]ightened mortgage regulations are expected to contribute to lower sales activity this year, though the extent to which they will weigh on housing markets across Canada will vary,” he said.[2]

Housing and Economic Growth

Experts are also warning of a soft landing for the Canadian housing market as a whole, which means real estate activity won’t contribute much to economic growth this year. In fact, it could even be a small drag on overall GDP. That means the Canadian economy will rely mostly on household spending to keep the engine running in 2017.[3]

CREA also said the number of newly listed homes dipped 3% in December compared to November, with about 60% of local markets experiencing a drop.

While policymakers have repeatedly intervened in the mortgage market to keep it from overheating, the Bank of Canada (BOC) has kept interest rates at rock bottom. In fact, Governor Stephen Poloz recently said that another interest rate cut was in the cards as the economy braces for a more protectionist United States under Donald Trump.[4]

Despite a more volatile Vancouver market, housing remains one of Canada’s biggest strengths. This will likely continue even as sales slow, given that housing inventories are falling in many urban centres, including Greater Toronto, Hamilton and southern Ontario. Tight supplies will likely keep upward pressure on home prices for the foreseeable future.

Sources

[1] Daniel Tencer (January 16, 2017). “Canadian Home Prices Slow After Vancouver Sales Drop 40%.”

[2] CNW (January 16, 2017). “Canadian home sales up from November to December.” Newsire.ca.

[3] Greg Bonnell (January 18, 2017). “Loonie suffers worst loss since Brexit vote, as BoC keeps cut on the table.” Business News Network.

[4] Barrie McKenna (January 18, 2017). “Bank of Canada says rate cut an option amid concern over Trump policies.” The Globe and Mail.