Out of all the provinces, Ontario and Quebec are always duking it out as the poorest province. Unfortunately though, Ontario is currently winning that race. Ontario is in pretty terrible shape when it comes to the amount of debt it owes, and there are a number of reasons for all the debt that it’s accrued. Of all those reasons though, times of recession and excessive spending on the part of the provincial government are generally what’s to blame.

Ontario’s Deficit

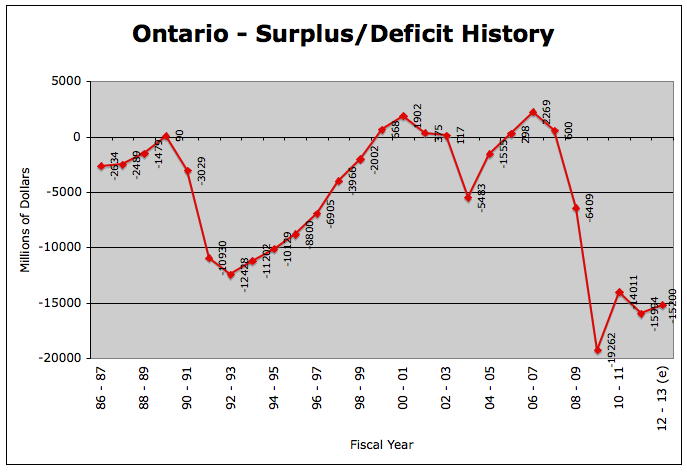

As you can see from the chart, there have been very few years that Ontario ran a surplus as opposed to a deficit. In fact, out of the 27 fiscal years that are represented, Ontario only ran a surplus for 8 of those years; that’s only 29.6 per cent of the time. The largest deficits did come at times of recession – both in the early 90s, as well as in 2008, just before the Great Recession hit – and then it took a very serious plunge. The amount of the deficit has always lessened after the years of recession, as governments tried to get the province back into the black. But still, it’s taken far too long each time, and Ontario simply hasn’t been seeing the surpluses that it’s used to.

Ontario’s Debt

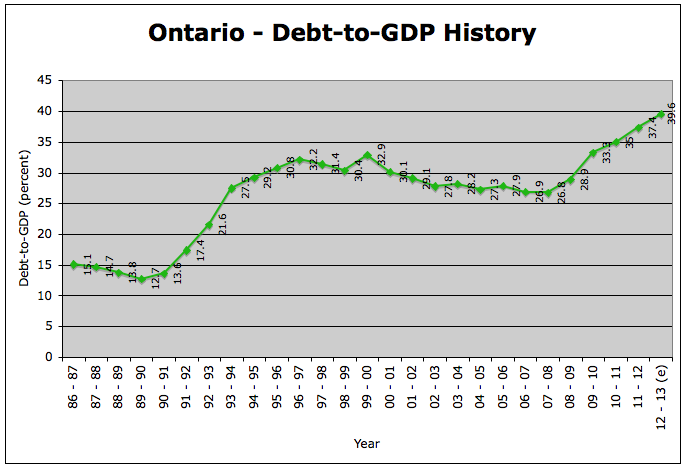

Ontario wasn’t always in the kind of trouble it’s in now. Unlike Alberta’s debt picture, they don’t have any recent history of being completely out of debt. However, this province’s debt wasn’t so bad in the early to late 80s. When the recession of the 90s hit though, things started to get bad for the province. And it wasn’t long before they got worse, as Ontario’s debt only continued to climb. Putting the two above charts together, you can see that Ontario’s deficit began to edge closer to a surplus. These were during the years of 1995 – 2000, the first year presented that Ontario actually ran a surplus.

These were the Mike Harris years of government. And while Harris may not have been the most popular Premiere to ever head Ontario’s government, it was the cutbacks he introduced that made many Ontarians see him as an enemy. These cutbacks included a number of things, including severe cuts to education (anyone who lived through Ontario-imposed work-to-rule remembers that,) as well as serious cuts to arts programs, and health services. While these cuts did hurt Ontarians in the short-term, they were exactly what was needed to stop the extreme deficits Ontario had been experiencing, and to help the province stem the growth of their overall debt.

Those changes that the Mike Harris administration imposed did their job, and Ontario’s debt-to-GDP ratio (a measure of overall wealth in any given province) remained fairly steady until 2003, when Harris left office, and even for the next several years. Unfortunately, when the Great Recession of 2008 hit, that debt-to-GDP ratio spiked. Since 2008, Ontario’s debt-to-GDP ratio has jumped by a drastic 37 per cent.

The latest recession was one large reason for this. Being that the majority of Ontario’s population, and jobs, are situated so closely to America’s border, the province took a particularly big hit during the recession. Exports to the United States dried up, and this included many forms of manufacturing – including the automotive industry. When the U.S.’ economy started to collapse, so too did the automotive industry in Ontario. This particular industry was hit very, very hard and Ontario felt the brunt of it.

But, you can’t talk about the plunge Ontario’s economy took without also talking about the amount of government spending that was happening at the same time. In 2003, the Liberals took over the provincial government, with Dalton McGuinty leading the way as Premiere. It’s true that just like the federal government needed to introduce stimulus spending in the form of lower interest rates in order to keep our economy churning during the recession, the provincial government of Ontario needed to do the same thing. But, the McGuinty government may have gone too far. In just about five years, from the 2007-2008 fiscal year to the 2012-2013 fiscal year, Ontario’s debt has almost doubled, going from $150.6 billion to $261.8 billion. And while the province’s deficit may have edged closer to a surplus after the latest recession, the province still hasn’t seen an actual surplus in all the years that McGuinty has been in power.

This is largely due to much of the excess spending that the Ontario Liberal government is often harshly criticized for. Those include the $1.1 billion spent on the Ontario Clean Energy Benefit; the $1.4 billion in temporary HST rebates; $1.3 billion in power supply contracts; and the $500-million per year the government is spending on full-day kindergarten that uses teachers instead of early childhood educators. While some of this spending and some of the stimulus packages can be explained, and may have even been needed for the province, many of them were simply expenditures that some feel the McGuinty used in order to get re-elected. Some of these expenses though, such as teachers in kindergarten classrooms, have also added to the job growth in Ontario – something that was very much needed after the recession. Especially after many Ontarians were left looking for work after the recession.

The McGuinty government is currently between a rock and a hard place (and they will be even more so once they come back after the prorogue that’s currently going on.) The provincial government is currently borrowing a whopping $58.4 million a day. And that’s simply too much. But the McGuinty government has also recently taken drastic steps in order to reduce that debt, and the province’s deficit. The most dramatic recently has been the proposed freezes on teachers’ wages, that would take place for the next two years, and help the province to climb out of some of its debt. But this too, has been met with harsh criticism, and even protests on the parts of teachers and even many student bodies within the province.

While Ontario’s debt is definitely bad for the province, it’s also very bad for the country as a whole. Because the country’s capital city, Ottawa, lies within Ontario, many believe that Ottawa will step in and save Ontario should they ever become too deep in debt. But the fact is, the province is already in over its head, and the federal government really isn’t in a position to come in and save them. Therefore, the idea that a bankrupt Ontario equals a bankrupt Canada, is unfortunately most likely true.

It’s time for everyone in Ontario, the provincial government and the residents within it, to come together to try to work out a solution. Any solution is going to be felt by everyone within the province, there’s no doubt about that. But owning up to our debt now and feeling the crunch that is inevitably coming, is a much better option than leaving it for our future generations to deal with.

Ontario has many, many major cities. They are:

Toronto

Ottawa

Hamilton

Mississauga

Kitchener

London

Windsor

Markham

Oshawa

Oakville

Barrie

Burlington

Cambridge

Guelph

Kingston

A little later on, we’ll take an in-depth look at each of these cities, and the debt picture within them.