As Toronto mortgage brokers, it’s something we see quite often. A person wants to apply for a mortgage, but they know they won’t qualify on their own (or they just found out that they won’t.) Panic-stricken, they start reaching for any option available. Can they get a co-signer? A guarantor? Who can they ask? Whoa, hold on a second!

A co-signer and a guarantor are two very different things, and it’s important that you understand them both. So that when the time comes to ask, you’ll know what you’re asking of the person.

Loan Co-signer

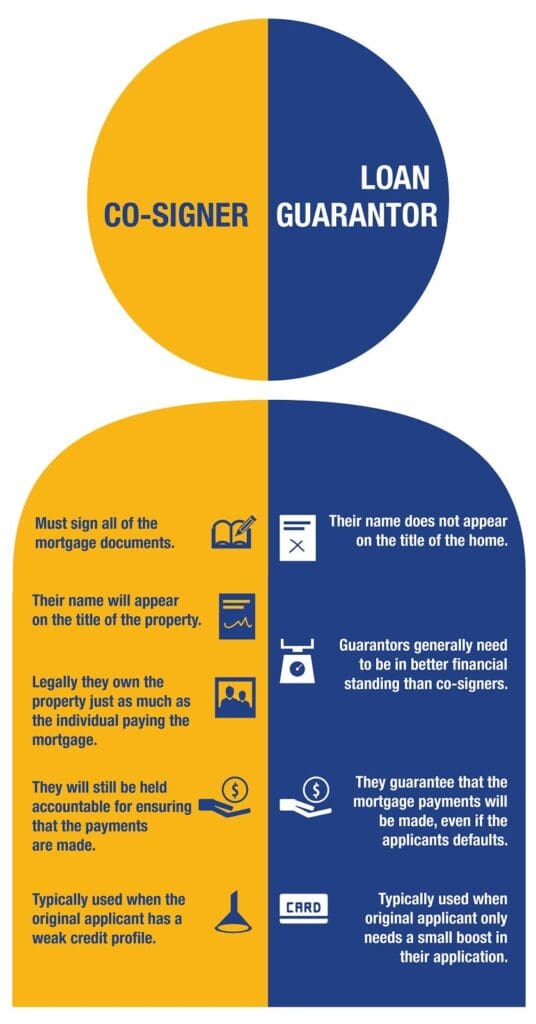

Both a co-signer and a guarantor can help otherwise ineligible individuals qualify for a mortgage. But, the responsibilities and the rights that the two have can be quite different. A co-signer, in essence, co-owns the home with the individual living in it and paying the mortgage. A co-signer must sign all of the mortgage documents and their name will appear on the title of the property.

Because legally they own the property just as much as the individual paying the mortgage, they will still be held accountable for ensuring that the payments are made. While it’s generally understood that the co-signer will not actually be making the payments, it must be understood by all parties that they will be required to do so should the original applicant default on the mortgage.

A co-signer is usually used when the original applicant has major problems getting a mortgage on their own due to income issues. A co-signer is used when the original applicant has no ability to qualify on their own merits. An applicant may be able to make the mortgage payments easily, but with unverifiable income such as service tips, or self-employment income. In these cases, a co-signer may be needed to bridge the income gap.

Loan Guarantor

A guarantor on the other hand, has much of the same responsibilities but not many of the same rights. A guarantor does just that – they guarantee that the mortgage payments will be made, even if the applicants defaults. Unlike a co-signer, a guarantor steps in when the original applicant is on the verge of qualifying, but simply needs a small boost to satisfy the lending criteria.

Guarantors generally need to be in better financial standing than co-signers, but their name does not appear on the title of the home. This means that while they will be responsible for covering the cost of the payments, they will not actually own the home, even if the original applicant defaults.

A mortgage guarantor is generally needed when the original applicant qualifies income-wise for a mortgage, but they might have problems with credit that are keeping them from qualifying on their own. Often when a young person is looking to buy their first home and they don’t yet have any credit, a loan guarantor will step in and guarantee to cover the loan. Another situation when a mortgage guarantor might be a good solution is when a married couple wants to apply for a second mortgage loan. If the mortgage is under one spouse’s name but they have run into credit problems since obtaining their first mortgage, the other spouse can simply act as a guarantor.

Cosigner and guarantor risk

Both guarantors and co-signers afford a mortgage applicant important benefits. When an applicant attempts to get a loan with a co-signer or guarantor, that person may qualify for a better interest rate than they may have been able to secure on their own. This is especially important for first-time homebuyers or those who haven’t yet built their credit.

On the other hand, guarantors and co-signers assume some risk that can leave them responsible for a significant amount of debt. A lender can pursue a co-signer for outstanding payments that the primary signer on the mortgage has failed to meet. The co-signer is responsible for 100 percent of the loan amount, which means a lender can collect the full payment amount from the co-signer immediately.

Guarantors have a similar responsibility for loans, but they only become liable for the loan once a lender has tried and failed to collect from the primary borrower through all reasonable means of recourse. Whereas a co-signer is fully on loan and title, which appears on their credit history, this is not the case for a mortgage guarantor.

There are only a few circumstances in which a lender may consider releasing you from your responsibility as a co-signer or mortgage guarantor. However, it’s more likely that the primary borrower will have to refinance or apply for a mortgage all over again for this to happen. Once the original applicant qualifies under their own merit, a guarantor or co-signer can then be removed. An advantage therefore of a guarantor is that they are not on title, so there is less paperwork associated with this transition.

As you can tell, signing a mortgage as a guarantor or co-signer is not a decision you should take lightly. It is challenging to have your name removed from a mortgage.

Should you run into issues when figuring out which solution is right for you, it’s important to discuss with a mortgage professional who can explain the benefits and drawbacks of all financing options.